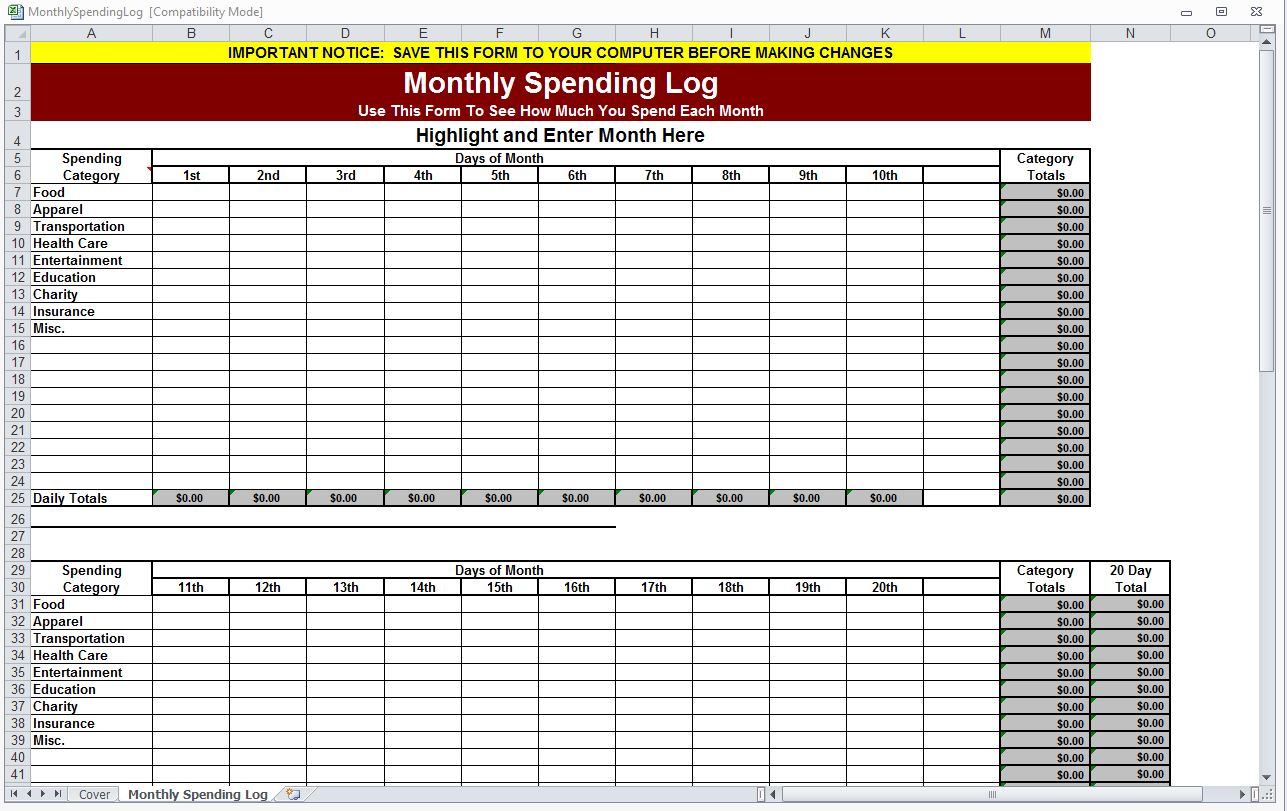

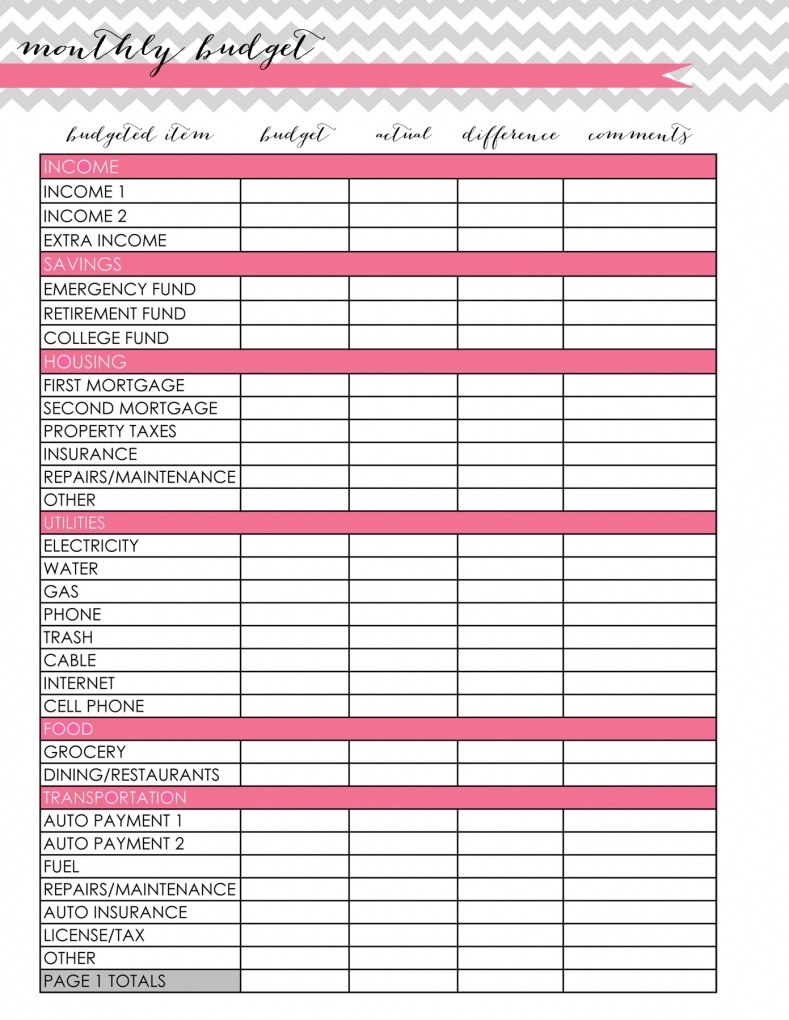

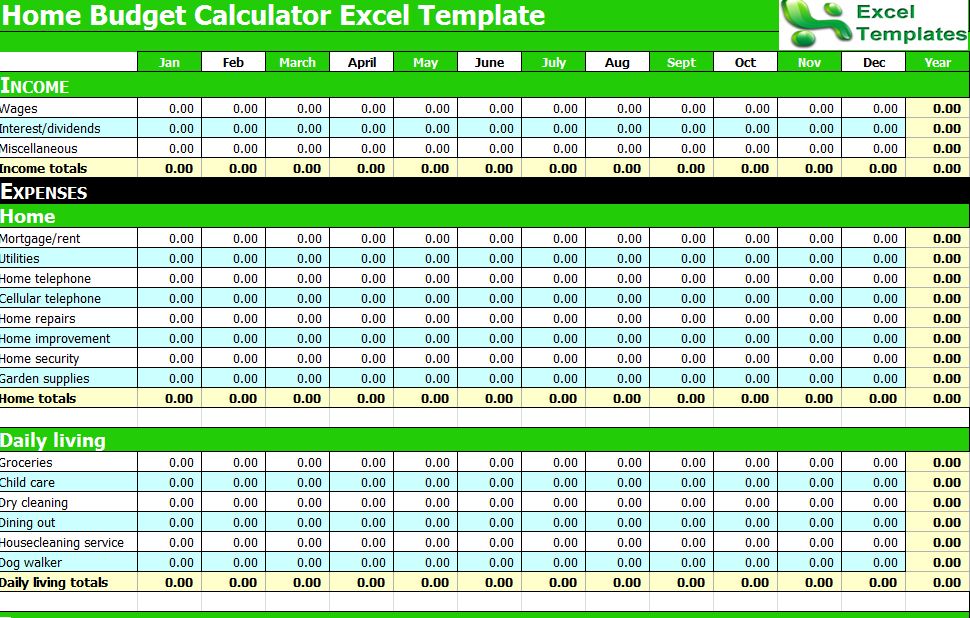

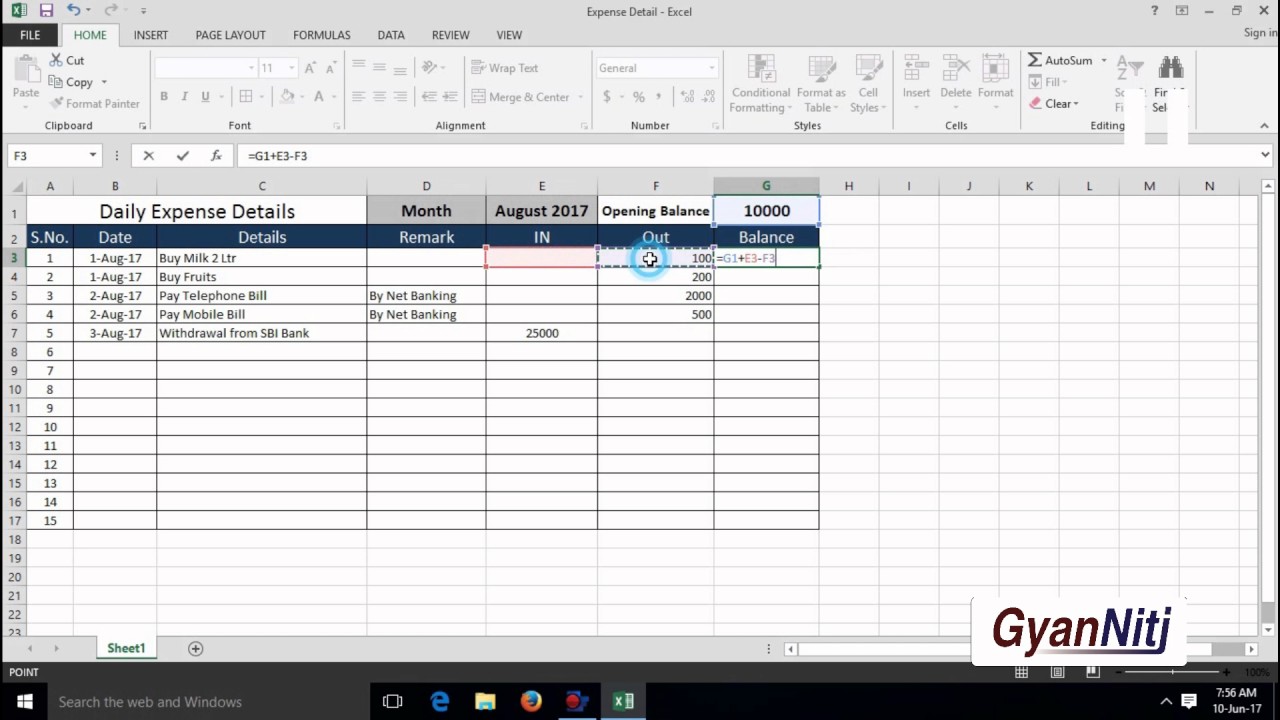

It is free and readily accessible online. Also, ensure that MS Excel is installed and if it is not installed, consider installing Google sheets that is another capable tool and can be used in the absence of Excel.

In short, the effectiveness of tracking expenses is not dependent on the method but rather the will and commitment of the consumer to follow it and be aware of when they spend more than they should.Īn expense tracking template does not have to be complex. Regardless of the method, tracking expenses should be a habit if one wants to succeed with money.

#Excel sheet for daily expenses in home software#

Using the software is a one-stop-shop for consumers where tracking and calculations can be done with much ease. Templates are made such that they can be customized to fit a person’s spending habits and saving needs. One chooses their preferred frequency of reporting, and after the period, a detailed expense report is generated by the app. Online resources allow the consumer to record expenses as they occur. Budgeting apps are also used to generate expense tracking templates. The third option is the use of online resources like downloadable expense tracking templates or programs to track expenses. However, using credit and debit card statements to track expenses does not capture any cash purchases made, compromising its accuracy. This method is less stressful and involves than a paper trail. A statement will outline every expense made by the credit or debit card. One can opt to request credit or debit card statements at the end of the month to see where or what they spent money on. A paper trail method of tracking expenses is sometimes reliant on memory, and one can forget to include a purchase leading to inaccurate records. Also, it requires people to safeguard their receipts so, they can transfer information on paper – it is common for receipts to get lost. Its drawback is that fewer and fewer people are carrying paper and pens these days, making physical records a bit difficult to keep up with. Also, all-cash transactions are captured.

Written down expenses can be compared to the credit card statement to verify if the records are in order meaning the person is able to keep his or her own records instead of over-relying on the credit card company. It is also beneficial to people less knowledgeable about technology, especially the elderly. Paper trail helps one be attentive when spending and encourages them to think carefully before making a purchase.

Paper trail methodĪlso referred to as pencil and paper, is a common method of tracking method that involves physically writing down expenses on a notebook or paper soon as they are made. Some prefer a more hands-on approach which involves noting down what they spend on, while others prefer using spreadsheets and other digital means. People can use whichever way, and the result would still be sufficient. A budget might have little or no impact if at all one does not closely track their spending.ĭifferent methods can be used to track expenses depending on convenience and preference. Tip: Avoid budgeting before tracking expenses. An expense tracking template can also be used for one-time events such as birthday parties, weddings, etc. Expense tracking templates for personal income management are usually simple, while those for businesses can be lengthy and detailed. Employees can also use an expense tracking template to record mileage, gas usage, meal expenses when on official duty, and other business expenses the employee would need to be reimbursed.Įxpenses on an expense tracking template will typically be in an itemized list accompanied with a description for each item. For businesses, an expense tracking template is used to keep track of daily or routine expenses such as transportation, conference fees, food, etc. An expense tracking template is a worksheet document used to track and organize a person’s or a business’s finances and help them plan for their monthly or yearly expenses.įor personal expense tracking, an expense tracking template records monthly income and household expenses such as clothing, recreation, travel, etc.

0 kommentar(er)

0 kommentar(er)